“Urgent discussions echo through financial arenas as central banks extend credit safety nets, coinciding with a decline in bank shares. The prevailing question revolves around whether this indicates the commencement of yet another financial turmoil. Assertions from policymakers, including the prime minister of the UK, and financial institutions assert steadiness, but the oscillating trend in banking shares hints at an inherent disquiet. In the U.S., regulators have boldly taken action by closing and liquidating three mid-size banks – Silicon Valley Bank, Signature Bank, and First Republic, constituting the most substantial setbacks since the 2008 economic downturn.

The focus now pivots towards U.S. labor statistics, delivering an unexpected blow as Initial Jobless Claims for the week concluding on April 28 surged by 242K, exceeding prognostications. Furthermore, Q1 Nonfarm Productivity witnessed a descent of 2.7%, while Unit Labor Cost for the corresponding period skyrocketed by 6.3%. The collective gaze now fixes on the April Nonfarm Payrolls, with market participants bracing for the repercussions.

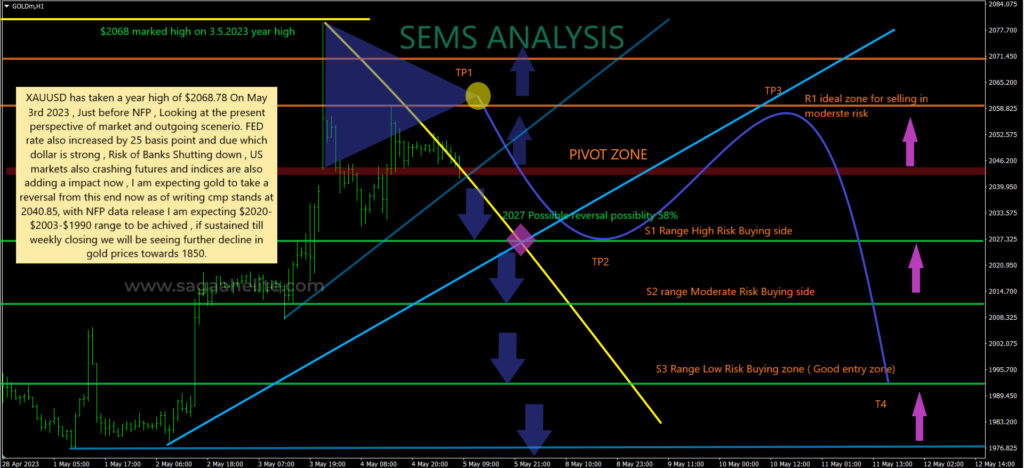

Amidst this scenario, XAUUSD achieved an annual pinnacle at $2068.78 on May 3, 2023, just before the revelation of NFP. Evaluating the ongoing market conditions and the evolving situation, the Federal Reserve’s elevation of interest rates by 25 basis points has fortified the dollar, amplifying the peril of additional bank closures and instigating a downturn in U.S. indices. The analyst envisions a shift in the trajectory of gold from its existing level of 2040.85, foreseeing a breach of the $2000 spectrum subsequent to the NFP disclosure. Should this descent persist until the week’s conclusion, a sustained decline towards the 1950-1900 range is anticipated.

“Awaiting a phase of vulnerability, proponents of the Yen anticipate a downturn until speculation reemerges regarding a potential adjustment in Bank of Japan policies at its June or July gatherings. The Japanese currency has descended to a low not witnessed in two months against the greenback following the BOJ’s choice to maintain its primary stimulus measures without changes. Options indicate an approximately even likelihood that it might reach 140 per dollar by the close of July. On May 2, 2023, USDJPY reached a pinnacle at 137.700 (impact on XAUUSD: trivial) before plummeting back to the current market price of $134.000 zone. The repercussions of the USDJPY descent are reflected in XAUUSD, pushing it beyond $2045.”

Key Resistance (R) and Support (S) Levels:

Resistance Levels (R):

- R1 2069

- R2 2090

- R3 2121

- R4 2140

- R5 2171

Support Levels (S):

- S1 2020

- S2 2009

- S3 1988

- S4 1970

- S5 1950