After executing a spontaneous maneuver at the resistance, the market transitioned into a period of consolidation before shaping a twin-peak pattern and a divergence. In my view, gold may initiate a retracement to evaluate support emanating from the resistance as the price has reached the primary resistance level on the 4H timeframe. I anticipate a brief correction at the resistance, targeting the 1962.40 support level. Over the last two months, XAUUSD has undergone significant fluctuations within the range of 2048 – 1998, rebounding to 2045 on 10.05.2023. In May 2023, XAUUSD encountered challenges at price zones 1966 and 1947, establishing its May low at 1932. Subsequently, gold surged to a peak of 1983 on 02.06.2023, just ahead of the NFP data release.

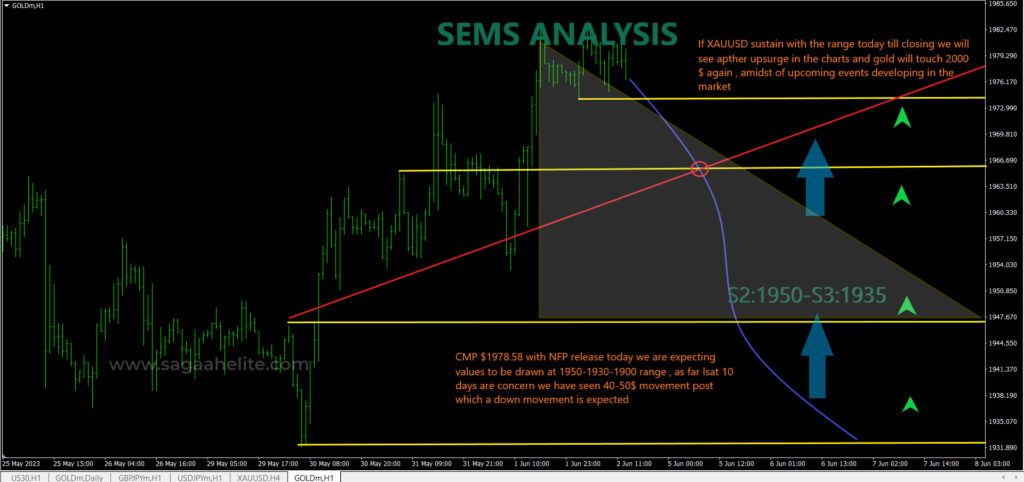

Current market price (CMP) stands at 1978.58. With today’s NFP data release, we anticipate values to gravitate towards the 1950-1930-1900 range, considering the events of the last 10 days. Notably, a movement of 40-50$ has been observed, hinting at a potential downward movement within the ranges specified in the chart.

Should XAUUSD maintain this range until closing today, we foresee another upward spike in the charts, propelling gold to touch the $2000 mark again, amidst the unfolding market developments.

Key Resistance (R) and Support (S) Levels:

Resistance Levels (R):

- R1 1992

- R2 2008

- R3 2019

- R4 2028

Support Levels (S):

- S1 2050

- S2 2035

- S3 2012

- S4 2000