Fed Holds Rates, Dollar Gains – Gold Caught in Tight Range Dollar Softens and Yields Ease

Gold (XAU/USD) is recovering modestly after Wednesday’s decline, trading near $3,300 on Thursday. The rebound comes as U.S. Treasury yields pull back across the curve and the U.S. Dollar struggles to extend gains after hitting a two-month high post-Fed.

Technical Snapshot: $3,300 in Focus, But Bearish Risks Remain

Immediate Support: $3,275–$3,260 zone (near 100-day SMA).

Critical Downside Level: $3,247–$3,228 (June swing low).

Near-Term Resistance: $3,315 followed by $3,328–$3,342 (horizontal barrier).

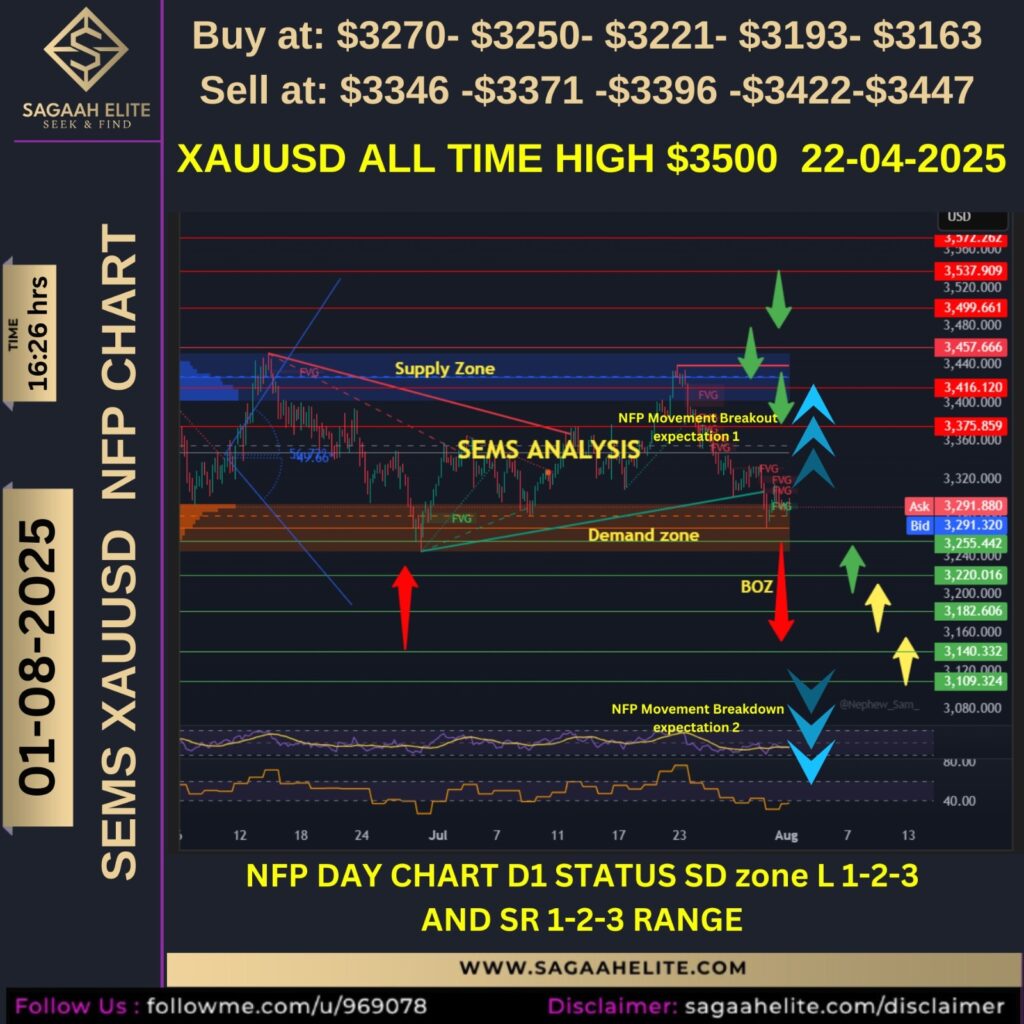

Daily Trading Levels as per NFP data release

Buy at: $3270- $3250- $3221- $3193- $3163

Sell at: $3346 -$3371 -$3396 -$3422-$3447

Daily oscillators have begun to turn negative, suggesting that upside attempts above $3,300 may be short-lived unless a strong breakout develops. If buyers manage a sustained move above $3,326-$3336, it could trigger a short-covering rally.

Fundamental Landscape: Dollar Strength vs. Gold’s Safe-Haven Pull

Fed Holds Rates: As expected, the U.S. Federal Reserve kept rates steady at 4.25%–4.5% for the fifth straight meeting. Notably, Fed Governors Bowman and Waller dissented, marking the first rate disagreement since 1993.

Powell’s Message: The Fed Chair made clear that no decisions had been made on a September rate cut. This, paired with solid economic growth, boosted the USD.

Strong Macro Data:

GDP:Q2 U.S. GDP rose 3.0% YoY vs. -0.5% prior.

ADP Jobs: Private payrolls climbed by 104,000 in July after a prior monthly decline.

These data points reduced market bets on near-term rate cuts, weighing on gold’s broader upside potential.

What’s Next: Key Data Watch

Traders are now turning their focus to the Non Farm Payroll Data along with ISM Manufacturing data to be released at 18:00 hrs today. Until then, market sentiment remains cautious. The gold market appears to be in wait-and-see mode, with bulls showing signs of hesitation and bears watching support levels closely.