XAUUSD NFP DAY ANALYSIS 7th June 2024

Spot Gold Prices and Market Movements

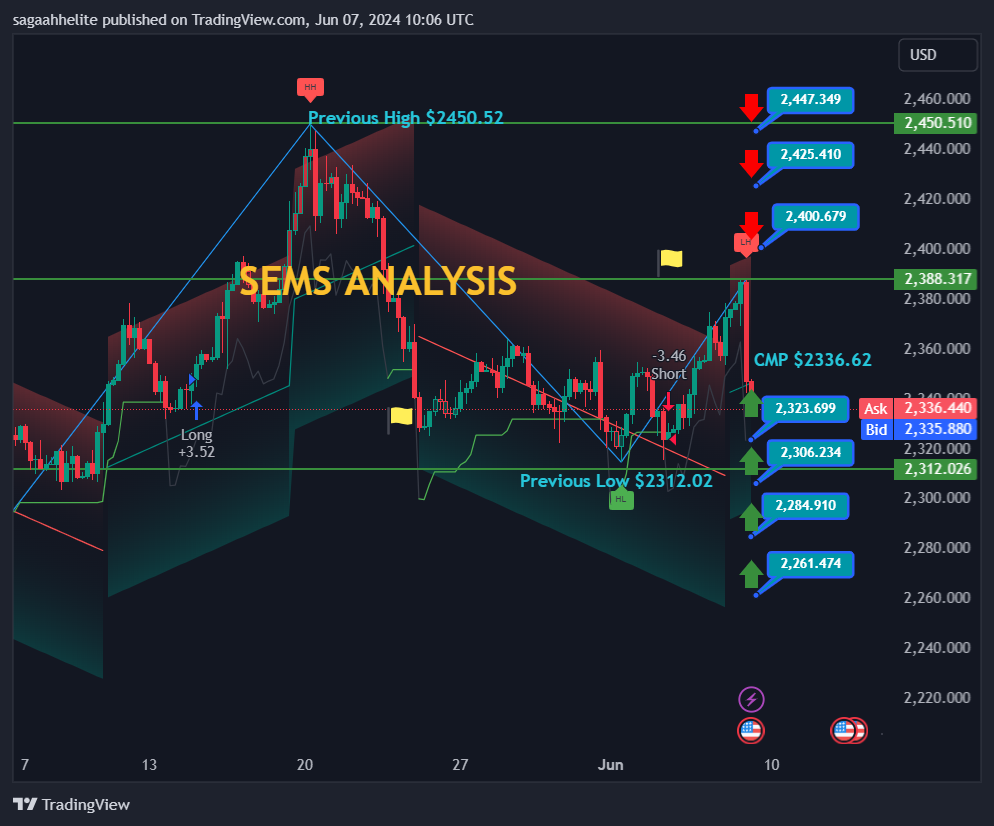

Current Trends: Spot gold prices have surged to $2,387, indicating hawkish market movements. However, with the opening of the UK session, a retracement to a low of $2,340.92 has already been observed.

Upcoming Data: Looking ahead, the release of the Non-Farm Payroll (NFP) data on June 7, 2024, is highly anticipated. Gold trading is expected to be cautious, with high trade volumes and significant numbers.

Market Closures: On Monday, the markets in China and Australia, which have a substantial influence on gold prices, will be closed due to holidays.

Influencing Factors

US Dollar and Treasury Yields: Several factors, such as hawkish Federal Reserve expectations, have revived the demand for the US Dollar across the market. Treasury bond yields have rallied to multi-week highs.

GDP Data and Jobless Claims: Thursday’s revision of GDP data from 1.3% to an estimated 1.6% suggests that jobless claims might increase, which could put pressure on the Dollar. This could affect gold values, potentially pushing them back to the $2,380-$2,400 range.

Heading towards NFP show as of writing XAUUSD SPOT GOLD Prices are crashing to $2338.45 cmp now and as mentioned in our last NFP the factors influencing gold on NFP day.

This helped gold price attempt a modest comeback, having incurred steep losses on Wednesday. A surprise uptick in the Core figure will reinforce delayed and less aggressive Fed rate cut expectations, providing extra legs to the US Dollar decline while smashing gold price.

Fundamental Which Might Affect XAUUSD:7-6-24

NFP Scenarios Friday:

- 150,000 or Less: Could trigger USD selloff, boosting gold.

- 200,000 to 250,000: May keep focus on inflation without major USD impact.

- 250,000 or More: Could lead to Fed rate cut, driving USD rally and gold drop

- Crucial jobs report for May. April’s NFP increase led to USD selling pressure.

Upcoming Influences:

The future of gold prices hinges on the forthcoming US Core PCE inflation data, due later in the American trading session on Friday. The Core PCE Price Index is anticipated to rise by 2.8% year-over-year in April, maintaining the same pace as observed in March.

If the Core PCE price index exceeds expectations, it could delay anticipated aggressive Federal Reserve rate cuts. This situation tends to strengthen the US dollar while exerting downward pressure on gold prices.

Conversely, if the Core PCE price index shows unexpected softness, it may increase the likelihood of a Federal Reserve rate cut in September, potentially driving a further increase in gold prices.

Depending on forthcoming economic indicators, US inflation data might propel XAUUSD into the $2288-$2250 Range or $2400-$2450 range

Technical Level and Analysis:

Buy at: $2323.69-$2306.23-$2286.23-$2261.91

Sell at: $2388.31-$2400.67-$2425.41-$

Warning: Do not risk more than 5% of your capital. You might lose your money.

Technical Status: XAUUSD:

D1 SMA100-P (2260.90) Buy

H4 SMA100-P (2368.74) Sell

H1 SMA100-P (2347.88) Sell

H4 SMA200-P(2351.01) Buy

RSI(14): Status: Oversold

STOCHRSI(14): Status: Oversold

ROC: Status: Buy

William%R: Status: Buy

ATR(14): Status: Buy

SOC: Status: Neutral

Ongoing Geo-political Tensions:

Israel – Iran

Russia – Ukraine

US-China Relations

Middle East Instability

Taiwan-China Relations

Key Support and Resistance Levels:

Key Support and Resistance Levels for XAU/USD are outlined for informed trading decisions.

Support Levels (S):

- S1: 2323.69

- S2: 2306.23

- S3: 2286.23

- S4: 2261.91

Resistance Levels (R):

- R1: 2388.31

- R2: 2400.67

- R3: 2425.41

- R4: 2447.34