The market has successfully reached its intended target. Demonstrating a decisive breakthrough of the triangular pattern and the pivotal level at 2000, the price exhibited an upward thrust candle from the support level. However, the current scenario indicates a diminishing momentum, evident in the gradual reduction in candle sizes. In my analysis, I propose considering the robust support, previously a resistance, as a favorable zone for initiating long trades. The ultimate target is set at the resistance of 2046.50.

The present trajectory showcases a retracement towards the primary support situated at 2000. Within this phase, a range zone has materialized following an upward impulse leg, potentially developing into a descending channel—a corrective phase counter to the overarching trend. My anticipation is that gold will persist in this pattern for a while, testing the support level and the ascending trendline, with an ultimate objective of reaching the resistance zone at 2030.

Post-rejection from the key level, the price underwent a pullback following an impulse move from the support level. Currently retracing roughly one-third of the bullish journey, the market hovers proximate to the upward trendline and the swing level at 2000. A noteworthy observation is the formation of a potential double bottom, hinting at a plausible upward trajectory to retest the resistance zone. My target lies at the resistance of 2025.

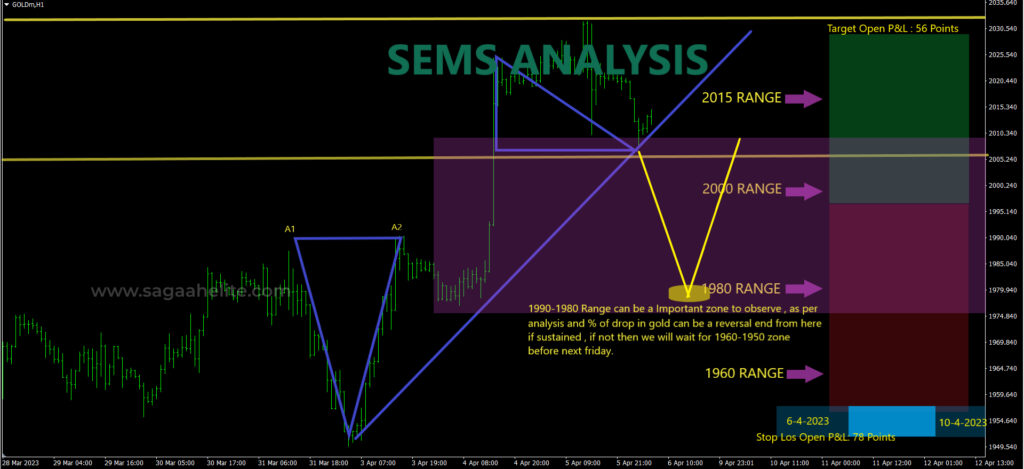

Drawing attention to the 1990-1980 range, this emerges as a pivotal zone warranting close observation. The percentage drop in gold within this range could signify a potential reversal, particularly if sustained for 4-5 consecutive sessions. However, in the absence of sustainability, a watchful approach prevails, monitoring for a potential decline to the 1960-1940 range by the upcoming Friday—an observation crucial within the one-week cycle.

Significant emphasis is placed on the 2015, 2000, 1980, and 1960 ranges, each representing distinctive phases in the market cycle.

Key Resistance (R) and Support (S) Levels:

Resistance Levels (R):

- R1: 2035

- R2: 2058

- R3: 2075

- R4: 2100

Support Levels (S):

- S1: 2008

- S2: 1995

- S3: 1980

- S4: 1965