Fundamentals That Might Impact XAUUSD: 6 September 2024

Gold prices have seen an upward trend over the past two days, as the U.S. Dollar (USD) faces increased supply and reaches new multi-day lows. Market sentiment has also been influenced by dovish remarks from San Francisco Federal Reserve President Mary Daly, who stated, “The Fed needs to cut policy rates because inflation is falling and the economy is slowing.”

Today’s U.S. Non-Farm Payrolls (NFP) and Wage Inflation data, set to be released at 18:00 hours, are key indicators that could drive market movements. These reports, along with the upcoming Federal Reserve rate decision, are expected to significantly impact trading levels for gold.

Yesterday, the ADP employment data offered limited guidance on inflation and payroll trends, highlighting uncertainty in the labor market. This suggests a potentially notable impact on both the USD and gold prices following today’s NFP release. The ADP data failed to provide clear insights into future inflation and employment trends, prompting a cautious market stance ahead of the NFP data.

According to the CME Group’s FedWatch Tool, there is currently a 42-45% probability that the Federal Reserve will cut interest rates by 50-70 basis points at its meeting on September 17-18, 2024. The market’s attention has now turned to the critical U.S. Non-Farm Payrolls report, which is expected to show an increase of 160,000 jobs in August and a slight reduction in the unemployment rate to 4.2%.

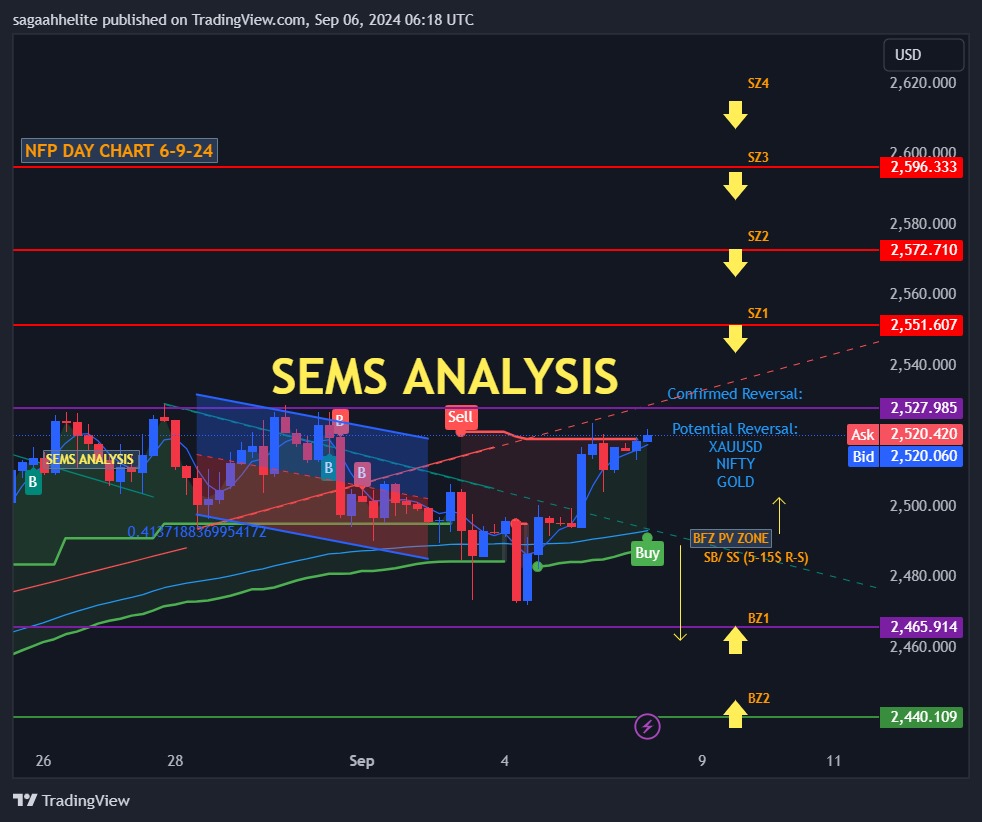

Important Range to Monitor before taking Decisions in Gold Trading :

•Middle East Tensions: Eased concerns over a regional war in the Middle East have improved market mood, helping gold regain ground lost earlier in the week.

•Israeli Response: Israeli authorities have retaliated against Hamas and Houthi Hizbullah by killing their commander and Lebanon Outrage for Revenge but aim to avoid a regional conflict, calming market fears.

Sell at:$2560-$2581-$2601-$2625

Buy at:$2465-$2440-$2415-$2395

CMP – $2517.54 (as of writing)  Warning: Do not risk more than 5% of your capital you might lose your money.Trading in gold and other financial markets involves significant risk and may result in substantial losses if not followed properly.*

Warning: Do not risk more than 5% of your capital you might lose your money.Trading in gold and other financial markets involves significant risk and may result in substantial losses if not followed properly.*

Data scheduled to be published at 18:00 hrs -20:30 hrs

18:00-USD-Average Hourly Earnings (MoM) (Aug)

18:00-USD-Average Hourly Earnings (YoY) (YoY) (Aug)

18:00-USD-Nonfarm Payrolls (Aug)

18:00-USD-Participation Rate (Aug)

18:00-USD-Private Nonfarm Payrolls (Aug)

18:00-USD-U6 Unemployment Rate (Aug)

18:00-USD-Unemployment Rate (Aug)

18:15-USD-FOMC Member Williams Speaks

20:30-USD-Fed Waller Speaks

Trading Strategy: Given the current market dynamics, we suggest the following:

For Potential Rebound:

- Buy Entry Target Range: $2545 (TP1)- $2559 (TP2)-$2568 (TP3)

For Potential Downtrend:

- Sell Entry Target Range: $2471 (TP1)- $2455 (TP2)- $2435 (TP3)

Strategic Insights:

- Monitor Geopolitical Developments: Key events in the Middle East, Europe, and Asia could be the tipping point for breaking the $2,480-$2460 resistance.

- Watch U.S. NFP Data Announcements: Federal Reserve actions and U.S. political developments will play a significant role in gold price movements.

- Prepare for Volatility: The gold market may see significant fluctuations, and understanding these patterns can help in making informed decisions.

Conclusion:

The $2,475 resistance remains a critical level in the gold market Before a major crash. While global factors could lead to a breakthrough, historical patterns suggest that caution is warranted. Investors should stay informed and be prepared for both upward and downward movements in the near term.