Market Analysis:

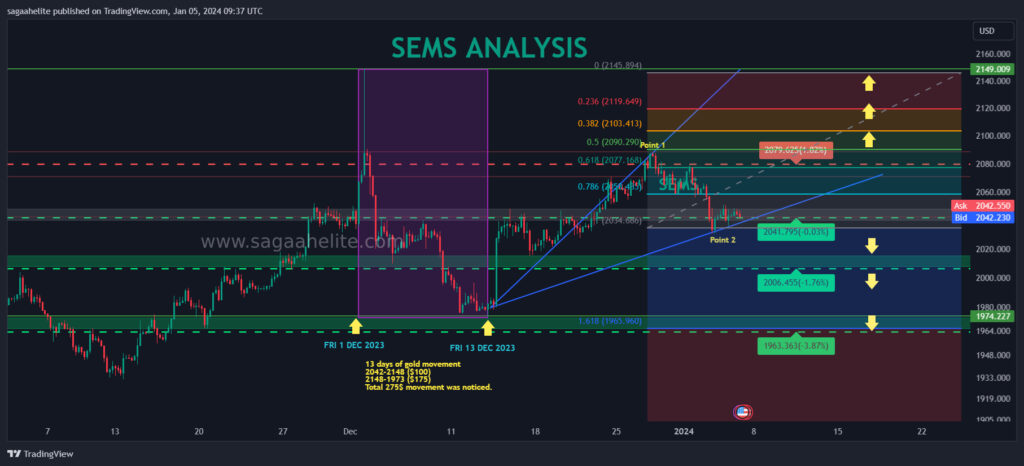

- Market Movement: The market recently experienced a significant bearish move, breaking through the swing zone. A recent price rebound occurred at the swing zone.

- Current Market Direction: The market is currently moving toward the swing zone above looking at the present perspective of market, 2 major war upfront, Interest Rate hike, Previous Powell statement for the interest rates, sterling debts, euro zone weakness and gold is being consistent since last 2 years for growth and stable upward movement.

- Expected Price Behavior: Anticipating a ranging market after the impulse leg from the resistance range of 2080-2100 range if not then again a year high can be seen with support of all the geopolitical news and Us treasury yield with 3.87% Hike and reduced interest rates. Awaiting NFP DATA, Labour market data, Employment Data to be released.

Technical Analysis:

- Daily Timeframe Analysis:

Inside bar formation observed on the daily timeframe. we are holding levels on 2090.

This formation may indicate a potential consolidation or indecision in the market. - Chart Patterns:

Identification of a head & shoulders pattern.

Neckline zone located between 2053 and 2065 range (considering crucial to breakout ). - Potential Market Entry:

Considering a pullback to the swing zone for a potential selling opportunity.

Looking for signals such as rejection bars or fake outs to confirm the entry. - Profit Target:

Setting a goal for the support level at 2038.500.-2025-2004 range will be trade booking zones for sell calls.

Setting a goal for the Resistance level at 2053-2065-2078-2090-2100 range will be trade booking zones for buy calls.

Risk Management:

- Stop-Loss Strategy:

Implementing a stop-loss strategy to manage potential losses. ( Low – Moderate- High)

Determining an appropriate level above the entry point to minimize risk. (Starting from low risk) - Position Sizing:

Calculating position size based on risk tolerance and stop-loss level. ( According to given RM and capital size and open positions)

Additional Factors:

- Fundamental Considerations:

Evaluating any relevant fundamental factors influencing the market. I will keep you guys posted in telegram group. - Market Sentiment:

Analysing market sentiment through tools like sentiment indicators or news will play a crucial role in achieving the numbers shared for trade and analysis, any variation and changes in given range will be directly effected due to market present sentiment, kindly use your wisdom while trading. - Monitoring Price Action:

Continuously monitoring price action for any new developments will also be taken in consideration for any new of immediate buying or selling in moderate or high-risk quantity.

Support & Resistance Levels:

Support Levels (S):

- S1: 2036

- S2: 2021

- S3: 2010

- S4: 1995

Resistance Levels (R):

- R1: 2054

- R2: 2078

- R3: 2098

- R4: 2109

Conclusion:

Summarize the overall analysis and reasoning behind the trade strategy, highlighting key technical and fundamental factors. Emphasize the importance of ongoing monitoring and flexibility in adjusting the strategy based on market dynamics.

Remember that trading decisions involve risk, and it’s essential to stay informed and adapt to changing market conditions.