Overview:

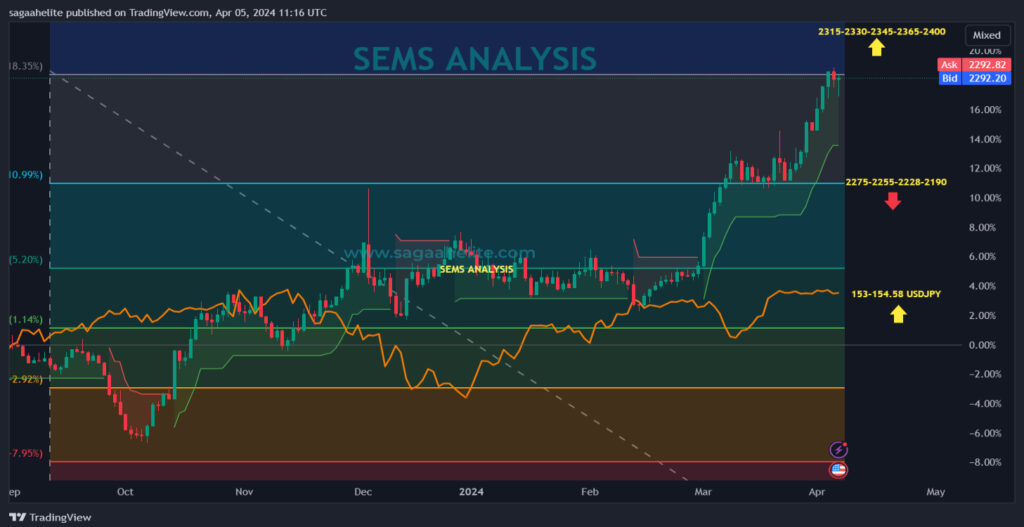

The Spot Gold price rebounded from the entry area, achieving new peaks. Considering the recent high levels, I anticipate a potential market retreat towards the support range of 2240-2200, where the initial strong movement happened and liquidity was absorbed under the prior day’s minimum.But against the NFP data results and DXY performance, Gold Rally Continued to 2330-2360 ahead of Week Frame numbers. Expected Extension for this range will be 2390-2420-2450.

In general, I foresee a turbulent market situation as upward movements might reverse from the support threshold upon encountering adverse reports.

My objective is to reach the resistance range of 2373.00-2420.55 before considering a decline.

Gold is denominated in US dollars, meaning that when gold prices increase, it reflects a weakening of the dollar in the markets. Despite the US dollar being the top performer among G10 currencies in 2024, gold prices have surged by 11% since the year began, following a 13% increase in 2023. This trend is notable considering the robust state of the US economy. Historically, bullish sentiment for XAUUSD (gold priced in US dollars) tends to strengthen during periods of economic weakness in the United States.

Gold’s surge is primarily linked to geopolitical factors and ongoing de-dollarization efforts:

Technical Levels and Analysis:

Key Support and Resistance Levels for XAU/USD are outlined for informed trading decisions.

Support Levels (S):

- S1: 2272.78

- S2: 2244.12

- S3: 2228.34

- S4: 2204.52

- S5: 2185.44

Resistance Levels (R):

- R1: 2325.54

- R2: 2352.87

- R3: 2378.47

- R4: 2405.89

- R5: 2435.95