Gold Market Dynamics:

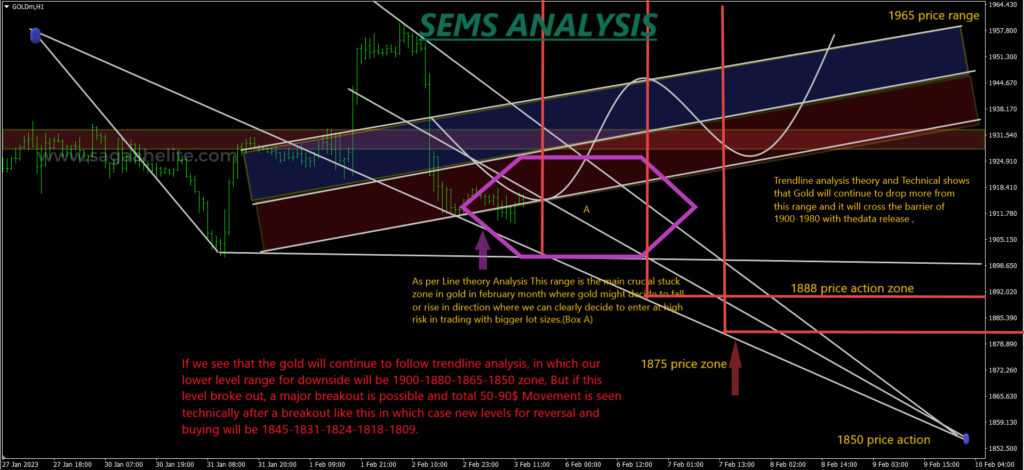

Gold is currently standing firm at a formidable support level of $1,910, where the lows from the previous day and week intersect, creating a resilient defense. A sustained breach below this level may initiate a pronounced descent towards $1,901, aligning with the 38.2% Fibonacci retracement for the month and the lower boundary of the four-hour Bollinger Band. Should the prevailing bearish sentiment persist, sellers could target the one-day S1 pivot point at $1,896.

In contrast, an initial barrier to upward movement is evident at $1,920, representing the 23.6% one-month Fibonacci level. A breakthrough above this juncture would bring the 23.6% one-day Fibonacci at $1,923 into focus.

Recent Gold Performance:

XAUUSD displayed notable movement, breaking through the $1836 threshold and achieving a pinnacle at $1866 in the initial week of the New Year. However, between January 9th and January 11th, the precious metal encountered significant selling pressure.

European Central Bank (ECB) Impact on Gold:

The European Central Bank recently opted for another interest rate hike and hinted at the likelihood of a similar move in the upcoming month. This accelerated pace of rate hikes by the ECB aims to combat elevated inflation in the eurozone, attributed to various factors, including the aftermath of the COVID-19 pandemic and the energy crisis stemming from geopolitical tensions like Russia’s conflict with Ukraine.

Factors Influencing the Gold Market:

Gold’s resilience is partially attributed to the persistent weakness observed in US Treasury bond yields. Attention is now turning to the imminent US labor market report, along with Fed Chair Jerome Powell’s scheduled speech in the subsequent week. Anticipated dovish signals from the Fed, coupled with subdued US Treasury bond yields, may serve as constraining factors for potential downward movements in Gold.

Investor focus is keenly on the Nonfarm Payrolls (NFP) report for January, expected to shed light on the future policy trajectory of the US Federal Reserve. A NFP print below expectations is poised to reinforce the outlook of a dovish Fed pivot, potentially triggering a risk rally at the expense of the US Dollar.

Key Resistance (R) and Support (S) Levels:

Resistance Levels (R):

- R1: 1932

- R2: 1962

- R3: 1974

- R4: 1995

Support Levels (S):

- S1: 1905

- S2: 1889

- S3: 1867

- S4: 1845

- S5: 1811

These designated levels provide essential markers for traders navigating the current dynamics in the Gold market, offering insights into potential breakthroughs or reversals.