Market Dynamics Unfold: A Shift in Resistance, Awaiting Nonfarm Payrolls

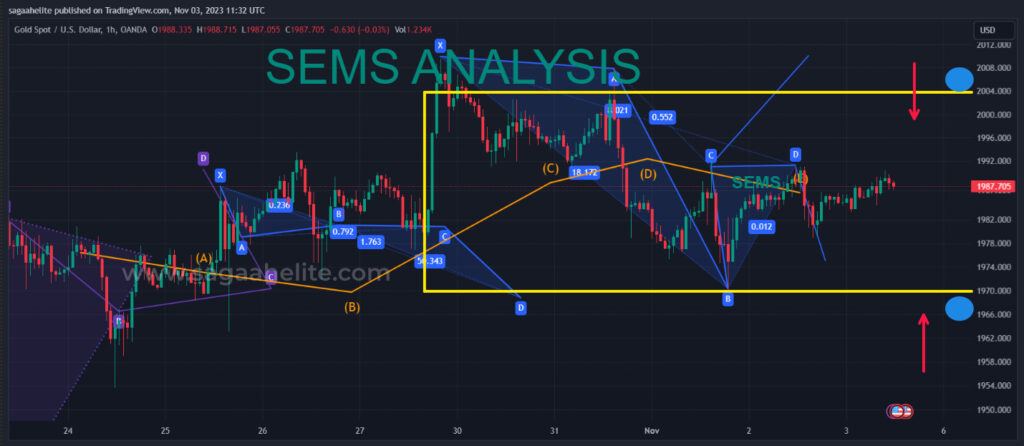

The market faced resistance, experiencing rejection and triggering a subsequent pullback. The support level at 1997 was breached, influencing a downward shift in the price. Speculation arises about the potential formation of a head and shoulders pattern. Notably, the resistance zone at 1995-1997 has historical significance, with the price consistently declining upon reaching this area. Anticipating a continuation of market ranging, the targeted level is set at the previous support of 1975.750.

Commodities Showcase Varied Performance in the Last Month: Geopolitical Factors at Play

Over the past month, commodities have demonstrated remarkable performance and statistics. Natural Gas (NG) exhibited a substantial spike of 8.59% within 12 days of the commencement of the Ukraine-Russia war. During the geopolitical turmoil, Aluminium emerged as the commodity reaching its peak. Gold, too, experienced an upswing, reaching a high of 2075.89 amid the heightened geopolitical tensions.

Gold’s Current Stand: Below $2,000, Awaiting Nonfarm Payrolls Catalyst

Presently, the current valuation of gold hovers slightly below the significant $2,000 milestone, anticipating a renewed surge fueled by the imminent release of the US Nonfarm Payrolls data. The pause in the devaluation of the US Dollar aligns seamlessly with the stabilization of US Treasury bond yields, establishing an atmosphere characterized by a cautious approach to risk. Delving into the intricacies of the daily technical setup reveals a bullish trend for gold, finding robust support in the constrained performance exhibited by both the US Dollar and US Treasury bond yields. Recent contractions in the US Dollar, triggered by a Federal Reserve (Fed) policy outlook marked by indecision, contribute substantially to the current buoyancy witnessed in the gold market.

US Dollar’s Sell-Off Persists: Fed’s Policy Outlook and BOE’s Hawkish Pause

The US Dollar’s sell-off persisted on Thursday, propelled by the benchmark 10-year US Treasury bond yields surpassing the crucial 4.70% level. This surge is fueled by expectations that the Federal Reserve has concluded its rate hikes. Simultaneously, a hawkish pause from the Bank of England (BOE) impacted the GBP/USD pair, intensifying the downward pressure on the US Dollar. While the BoE maintained the policy rate at 5.25%, as anticipated, three policymakers advocated for a hike, signaling potential future rate increases.

Key Trading Range for XAUUSD: A Strategy Amidst Market Dynamics

In the current market scenario, the critical trading range for XAUUSD is outlined as follows:

Selling Levels: 2004-2015-2025

Buying Levels: 1950-1975-1985

Adhering to these levels and relying on Support and Resistance (SR) levels provided by algorithms is recommended during such market conditions.