Overview:

The following analysis provides insights into current market conditions based on recent data and live prices for Gold (XAUUSD), the US Dollar Index (DXY), USDJPY, and Silver.

1. Federal Reserve Interest Rate Outlook:

The Federal Reserve has maintained its interest rates, as per recent information. A strict denial of a rate cut in March suggests a continuation of the current interest rate policy.

There is speculation that the Federal Reserve might postpone any rate adjustments until May.

2. XAUUSD (Gold/USD) Analysis:

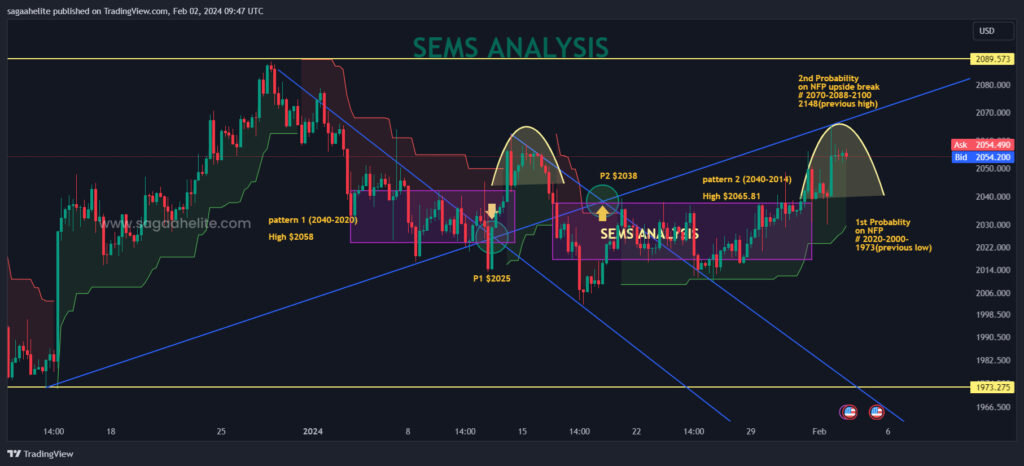

XAUUSD has exhibited a pattern of consolidation within a defined range over the last 40 days. This consolidation follows a repetitive pattern, indicating potential trading opportunities.

Historical price patterns from 2040 to 2020 and 2040 to 2014 provide key resistance levels at $2058 and $2065.81, respectively

XAUUSD has exhibited a pattern of consolidation within a defined range over the last 40 days. This consolidation follows a repetitive pattern, indicating potential trading opportunities.

Historical price patterns from 2040 to 2020 and 2040 to 2014 provide key resistance levels at $2058 and $2065.81, respectively

Additional support and resistance levels:

Support Levels (S):

- S1: 2020

- S2: 2000

- S3: 1984

- S4: 1966

- S5: 1945

Resistance Levels (R):

- R1: 2075

- R2: 2095

- R3: 2110

- R4: 2128

- R5: 2148

Despite the USD weakness and increasing debt, the denial of Federal Reserve interest rate increments may support a bullish bias for gold prices.

3. US Dollar Index (DXY) Assessment:

DXY is currently facing pressure near the 103.80 level. This suggests a potential struggle for the US dollar to maintain its strength against a basket of major currencies.

The pressure on DXY may influence trading strategies and investment decisions across various currency pairs, including USDJPY.

4. USDJPY Analysis:

USDJPY’s performance is closely tied to the strength of the US dollar. Pressure on the US dollar, as indicated by the DXY, may lead to downside pressure on USDJPY.

Traders and investors should monitor key support and resistance levels on USDJPY to identify potential entry and exit points amid changing market dynamics.

5. Silver Market Outlook:

Silver prices are influenced by multiple factors, including industrial demand, investor sentiment, and currency movements.

Given the current market conditions, traders should remain vigilant for potential price fluctuations in silver, which may present both trading opportunities and risks.

6. Non-Farm Payrolls (NFP) and Market Sentiment:

The overall outlook for Non-Farm Payrolls (NFP) is negative, with potential implications for unemployment rates.

Two probability scenarios have been identified based on historical patterns, offering insights into potential price movements following the NFP release:

Probability Scenario 1: NFP may lead to a downside move from 2020 to 2000, targeting a level of 1973 (previous low).

Probability Scenario 2: An upside break from 2070 to 2088 may occur, targeting a level of 2100 and potentially reaching 2148 (previous high).

Conclusion:

The analysis highlights the current market landscape for Gold (XAUUSD), the US Dollar Index (DXY), USDJPY, and Silver, incorporating recent data and live market prices. Traders and investors are encouraged to remain informed and adaptable to navigate evolving market conditions effectively.