Gold Market Insight:

The gold market experienced a retracement from the resistance zone following a significant upward surge, and now it is edging closer to the recent resistance level at 1840. Noteworthy is the historical response of the market to this particular zone, prompting considerations of a potential downturn. The prevailing market trend leans towards a downward trajectory, and the prospect of a false breakout, marked by an extended tail on a bar, hints at the likelihood of an impending decline. The targeted level for this bearish outlook aligns with the support at 1814.

US-China Diplomatic Dynamics:

Ongoing diplomatic tensions between the United States and China have intensified. China voiced criticism of the latest Philippines agreement, citing concerns that US actions are heightening regional tension and undermining peace and stability. The US responded with sanctions on five China-based suppliers connected to an Iranian company involved in supplying drones to Russia. Simultaneously, 17 Hong Kong businesses are under sanctions for their participation in a significant shadow banking system designed for Iranian firms. President Joe Biden’s proposed budget allocates substantial funding to Pacific islands, a strategic move seen as an effort to counter China’s influence.

Taxation Shifts under Biden:

President Joe Biden is advocating for a series of new tax increases, targeting billionaires, affluent investors, and corporations. The proposed budget calls for a 25% minimum tax on billionaires, signaling a shift in the country’s approach to taxation.

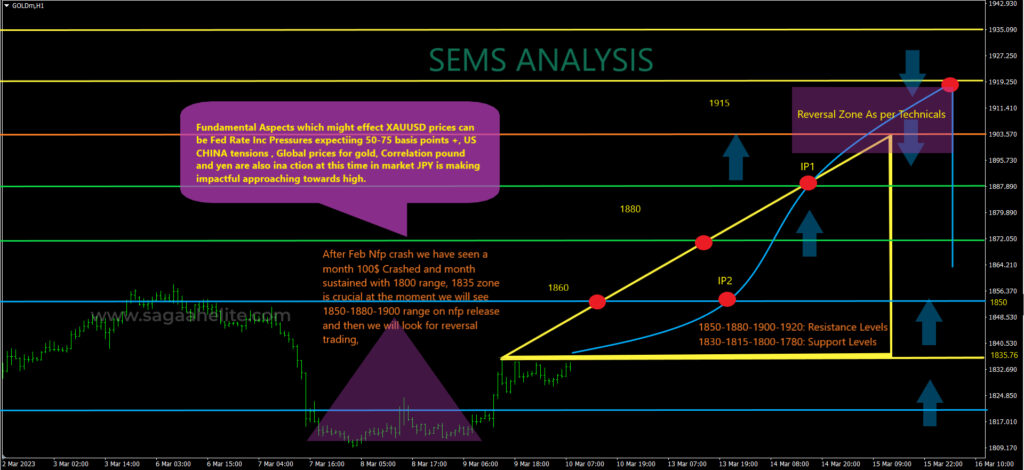

US Nonfarm Payrolls Impact on Gold:

Gold prices (XAU/USD) are currently under pressure around the $1,832 mark, with market attention turning to the upcoming US jobs report. The recent tumultuous market activity, triggered by the Bank of Japan’s inaction, has added an element of uncertainty. Notably, the weakening in gold prices seems more linked to a prevailing risk-off sentiment rather than direct correlation with US Treasury bond yields and the US Dollar, both of which have seen recent declines. The upcoming US jobs report for February is poised to be a significant influencer.

Projected Gold Price Movements:

In the event of a bearish continuation, the gold price may experience a further descent towards the $1800/1750 zone, with potential halting points at 1780 or 1740, possibly signaling a reversal. Conversely, a bullish scenario could unfold if the price surpasses the $1866 barrier, with targets at $1890, followed by $1915 and $1945. Caution is advised, with potential selling opportunities in the $1947-1966 zone.

Key Resistance (R) and Support (S) Levels:

Resistance Levels (R):

- R1: 1834

- R2: 1855

- R3: 1862

- R4: 1875

- R5: 1895

Support Levels (S):

- S1: 1820

- S2: 1808

- S3: 1790

- S4: 1782

- S5: 1765

These designated levels serve as vital markers for traders navigating the dynamic gold market, providing potential insights into reversal or breakout scenarios.