XAUUSD persists within the same range zone, showing an unconventional market response to highly positive data like NFP, Employment claims, and Production rate. This is in stark contrast to the notable movements of $150-$200 witnessed in August 2021 due to NFP data, with the current market fluctuations limited to a mere few tens of dollars.

Crucial Factors:

US Government Shutdown:

A last-minute spending bill was passed by the Senate on October 1, 2023, averting a government shutdown. This move prevents a detrimental domino effect on the American public and economy. With sufficient votes, the Senate approved a stopgap spending bill, ensuring federal government funding until November 17 and avoiding a shutdown.

The Bank of Japan’s Initiative:

Proposing to purchase ¥675bn worth of Japanese government bonds maturing between five and 10 years, this initiative is part of a comprehensive ¥1.9tn ($12.7bn) JGB purchase across various maturities on Wednesday.

US 30-Year Mortgage Rate: Experiencing a notable rise of 12 basis points to 7.53% in the week ending September 29, the US 30-Year Mortgage Rate, according to Mortgage Bankers Association data, recorded the most significant increase since mid-August. The home-purchase applications index saw a 5.7% decline to 136.6, the lowest level since 1995. Over four weeks, the 30-year fixed rate climbed by 32 basis points, contributing to one of the most unaffordable housing markets on record.

Yen’s Rebound and Japanese Intervention Speculation:

Despite falling below ¥150 on Tuesday, the yen swiftly rebounded to ¥147.3, prompting speculation of potential Japanese intervention. However, consensus among foreign exchange analysts and dealers in Tokyo suggests that direct currency intervention likely did not transpire. Japanese Finance Minister Shunichi Suzuki refrained from commenting on whether Tokyo intervened in the exchange rate market.

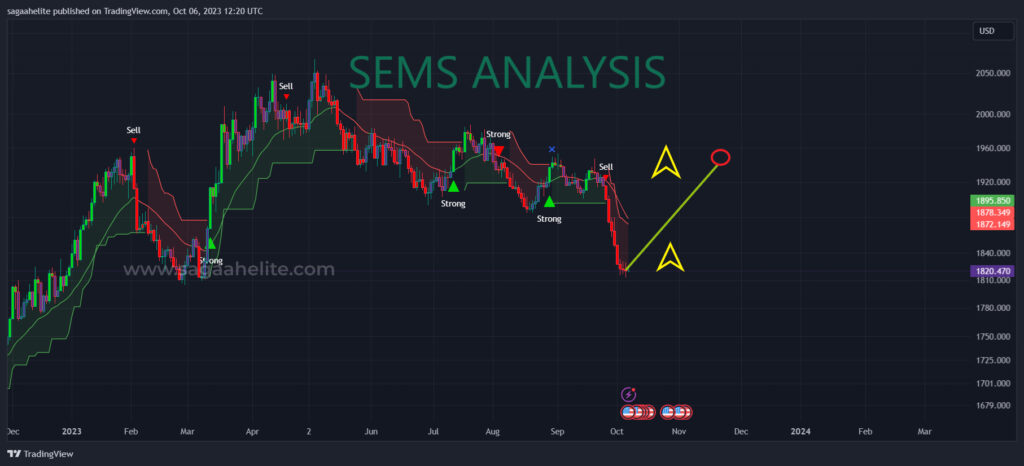

Gold Price Movement:

The gold price has breached the range zone, forming yet another lower low. The market is essentially consolidating around the support level, constituting a demand zone. Movement is typically lateral at key levels, and given the downward channel, there’s a likelihood of further descent to retest the support level. Anticipating a pullback to resistance, awaiting confirmation becomes paramount. The target is set at the support level of 1816.50.

Stock Session and Market Trigger:

With the Stock Session commencement, observing whether increased volume triggers the market into a safer zone for entering Buy or Sell trades becomes crucial. This approach is deemed the optimal strategy to circumvent unnecessary losses and account floatings.

In navigating these conditions, adhering to the provided range and levels of 1800-1836 is advisable. In such times, relying on Support and Resistance (SR) levels provided by algorithms and adhering to the established trading plan proves to be the most effective approach.

Amidst these conditions, adhering to the provided range and levels of 1800-1836 is advisable. In such times, relying on Support and Resistance (SR) levels provided by algorithms and adhering to the established trading plan proves to be the most effective approach.

Key Resistance (R) and Support (S) Levels:

Support Levels (S):

- S1-1812

- S2-1800

- S3-1790

- S4-1777

Resistance Levels (R):

- R1-1823

- R2-1838

- R3-1845

- R4-1855