1. US Dollar Index (DXY):

Dropped below the 104.00 support level.

10-year US Treasury yields decreased to around 3.69%.

Federal Reserve Chair Jerome Powell hinted at a potential slowdown in the extent of an interest rate hike in December.

2. Japanese Yen (JPY):

Advanced to a six-month high against the dollar.

Market speculation that Japan’s decision to raise its bond-yield cap could lead to further policy tightening.

The Japanese Yen saw a notable uptick, reaching a six-month high against the US Dollar. This movement is attributed to Japan’s decision to raise its bond-yield cap last month, sparking speculations about further policy tightening.

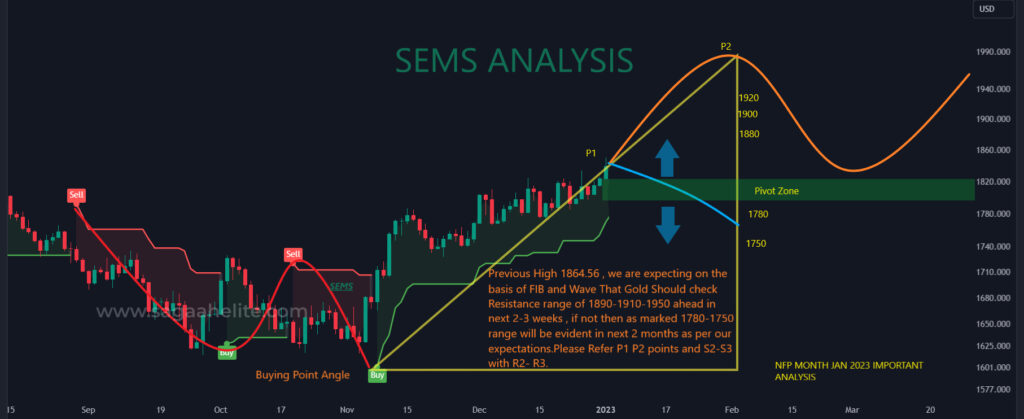

3. Gold (XAUUSD):

Current market price (CMP) at $1834.

DXY rose from 103.00 to 105.00 in the last three days.

US10YT (10-year US Treasury yields) declined from 3.810 to 3.700 during the same period.

USDJPY experienced a notable rise from 129.900 to 134.300, forming a V-shaped pattern on the H4 chart.

XAUUSD Bearish Scenario:

Possible decline to $1790-1760 range.

Further potential targets: 1755, 1735.

Reversal expected if a halt occurs at 1735 zone.

XAUUSD Bullish Scenario:

Possible decline to $1790-1760 range.

Further potential targets: 1755, 1735.

Reversal expected if a halt occurs at 1735 zone.

Key Resistance (R) and Support (S) Levels:

Resistance Levels (R):

- R1: 1828

- R2: 1842

- R3: 1875

- R4: 1886

- R5: 1908

Support Levels (S):

- S1: 1809

- S2: 1795

- S3: 1778

- S4: 1761

- S5: 1735

The analysis combines both fundamental and technical factors to provide a comprehensive view of the market. Keep in mind that financial markets are dynamic, and conditions can change rapidly based on various factors, including economic data releases and geopolitical events. Traders and investors should stay informed and adapt their strategies accordingly.

This analysis blends fundamental and technical elements to offer a holistic perspective. It’s important to note that market conditions are dynamic, and traders should remain vigilant, adapting their strategies based on evolving economic data and geopolitical developments.