XAUUSD is Making bearish wedge formation on the four-hour chart,The US NFP will emerge as the main market driver for gold rise, as it will offer fresh insights on the Fed’s next interest rate move.

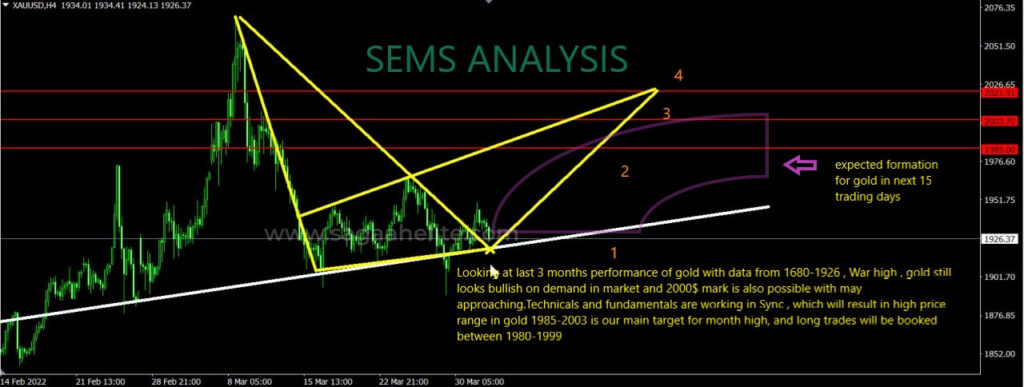

Looking at last 3 months performance of gold with data from 1680-1926 range, war high, gold still looks bullish on demand and in market and $2000 mark value is also possible wit may approaching. Technicals and fundamentals are working in sync, which will result in high price range in gold 1985-2003 is our main target for month high and long trades will be booked between 1980-1999 value.

Gold price is lacking a clear directional bias, as investors,are hesitant to place fresh bets. Further, the resumption of the bond rout is fuelling a rebound in the US Treasury yields across the curve, which is warranting caution for gold bulls. Meanwhile, the US dollar also extends its latest advance amid a cautious.

XAUUSD Support and Resistance Levels:

Resistance Levels (R):

- R1:1935

- R2:1970

- R3:1989

- R4:2003

Support Levels (S):

- S1:1928

- S2:1908

- S3:1890

- S4:1875

Immediate Seeling Buying action can be taken on 20-40$ range from Current market price zone.