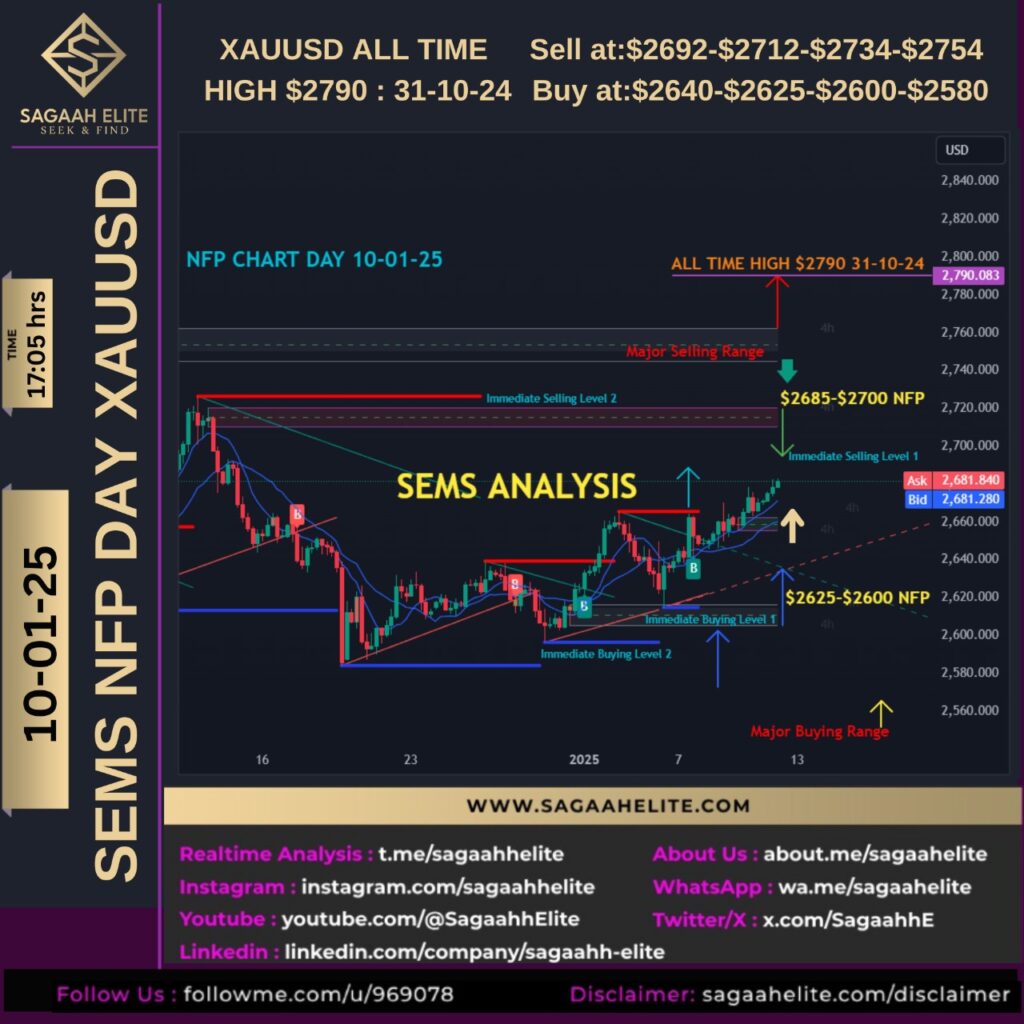

XAUUSD (Spot Gold) NFP DAY 🔖 10-1-2025 🚨

Sell at: $2692-$2712-$2734-$2754

Buy at: $2640-$2625-$2600-$2580

CMP – $2679.45 (as of writing) 📈

⚠️Warning: Do not risk more than 5% of your capital. Trading in gold and other financial markets involves significant risk and may result in substantial losses.

🚨📝Data scheduled to be published at 19:00 hrs

9:00 USD Average Hourly Earnings (YoY) (YoY) (Dec) 4.0% 4.0%

19:00 USD Average Hourly Earnings (MoM) (Dec) 0.3% 0.4%

19:00 USD Nonfarm Payrolls (Dec) 164K 227K

19:00 USD Participation Rate (Dec) 62.5%

19:00 USD Private Nonfarm Payrolls (Dec) 135K 194K

19:00 USD U6 Unemployment Rate (Dec) 7.8%

19:00 USD Unemployment Rate (Dec) 4.2% 4.2%

Fundamentals That Might Affect XAUUSD on NFP Day and Weekly Projections: 10-1-25

Gold Prices Set for Weekly Gain Amid Anticipation of US Jobs Data:

Gold prices remained near a four-week high on Friday, positioning for their best weekly performance since mid-November. Investors are closely watching upcoming U.S. jobs data to assess the Federal Reserve’s potential pace of interest rate cuts throughout the year.

📈 Treasury Yields and Market Dynamics

🔍 Open Interest and Rising Yields

Recent shifts in open interest data on US 10-year note futures show that traders have consistently increased their bets on higher yields daily since the start of the year. This trend has driven the 10-year yield closer to 5%, reflecting a growing appetite for bearish positions in the Treasury market.

- 📊 20-Year Yield: Surpassed 5% for the first time since 2023, driven by concerns over potential inflationary pressures and wider fiscal deficits linked to President-elect Donald Trump’s policy proposals.

- 📊 30-Year Yield: Climbed to 4.96%, while the 10-year yield rose to nearly 4.73%, approaching its highest levels since November 2023.

These moves are consistent with trends observed in both the UK and emerging markets, where yields have similarly surged.

📉 Markets Await Crucial Employment Data Amid Recession Fears

Investors remain on edge as they await the release of key employment figures, a critical indicator that could signal the trajectory of the U.S. economy and the potential onset of a recession. The 10-year Treasury yield, a bellwether for economic sentiment, is hovering near its highest point since April, highlighting market anxiety over upcoming data.

Potential Outcomes:

- 📈 Stronger-than-expected jobs data could reinforce the Fed’s cautious stance on rate cuts, maintaining upward pressure on yields.

- 📉 Weaker employment numbers may fuel recession fears, potentially prompting a more aggressive policy easing by the Fed and a rally in safe-haven assets like gold.

💡 Implications for Gold and Treasury Markets

Gold Market

Gold’s trajectory this week suggests that investors are hedging against economic uncertainty and inflation risks, particularly as the Fed’s policy outlook remains in flux.

Treasury Market

The rise in Treasury yields, particularly in long-dated bonds like the 20-year and 30-year Treasuries, indicates market skepticism about the future path of inflation and government debt levels under the incoming administration.