🚨 XAUUSD (Spot Gold) 🔖 4-10-2024 🚨

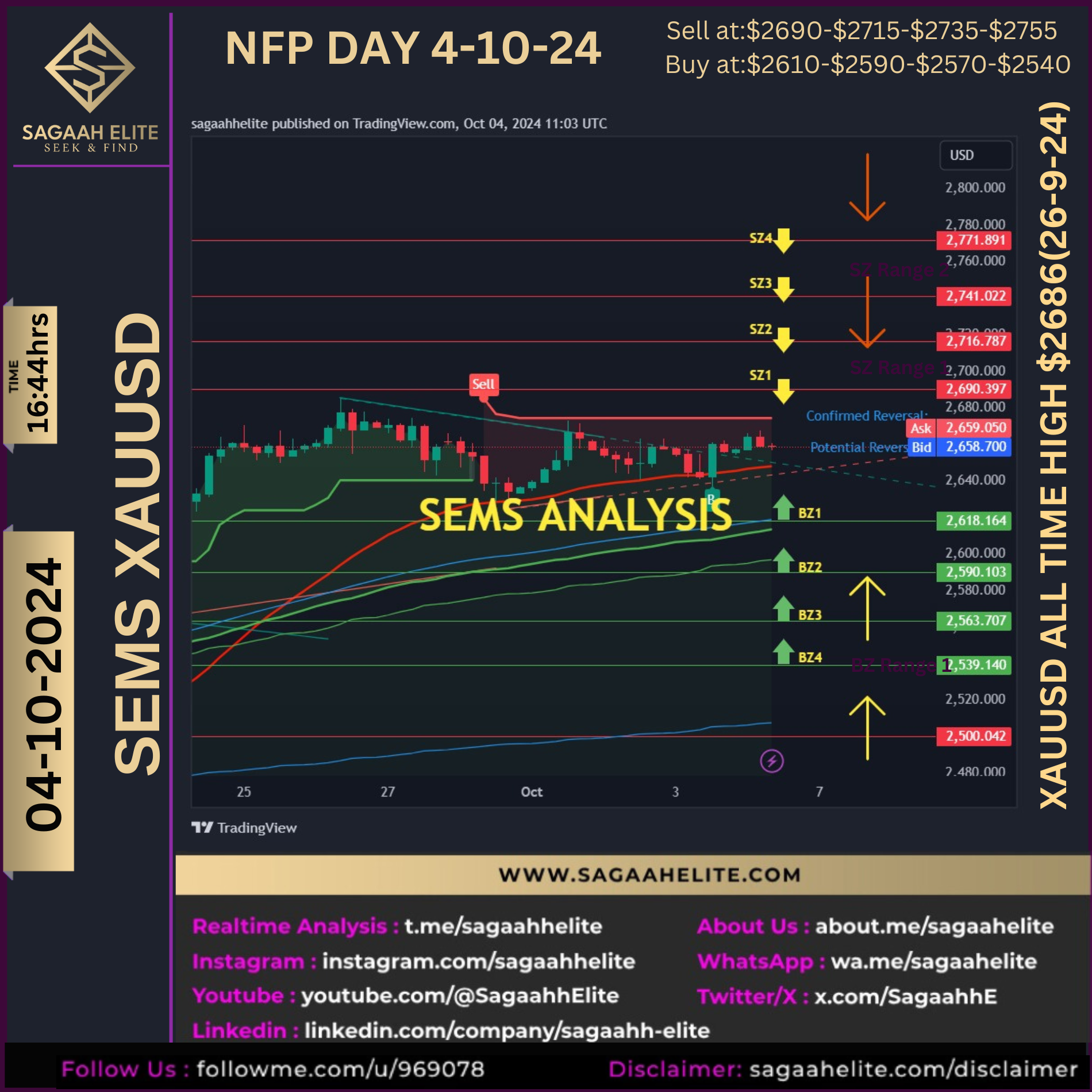

Sell at:$2690-$2715-$2735-$2755

Buy at:$2610-$2590-$2570-$2540

CMP – $2659.48 (as of writing) 📈

⚠️Warning: Do not risk more than 5% of your capital. Trading in gold and other financial markets involves significant risk and may result in substantial losses.

🚨📝Data scheduled to be published at 18:00 hrs-20:00 hrs:

18:00 USD Average Hourly Earnings (MoM) (Sep) 0.3% 0.4%

18:00 USD Average Hourly Earnings (YoY) (YoY) (Sep) 3.8% 3.8%

18:00 USD Nonfarm Payrolls (Sep) 147K 142K

18:00 USD Participation Rate (Sep) 62.7%

18:00 USD Private Nonfarm Payrolls (Sep) 125K 118K

18:00 USD U6 Unemployment Rate (Sep) 7.9%

18:00 USD Unemployment Rate (Sep) 4.2% 4.2%

18:30 USD FOMC Member Williams Speaks

Trading Strategy: Given the current market dynamics, we suggest the following:

🟢For Potential Rebound:

• Buy Entry Target Range: $2685(TP1)- $2695(TP2) -$2710(TP3)-$2720 (TP4)

🔴For Continued Downtrend:

• Sell Entry Target Range: $2625(TP1)- $2605(TP2)- $2590(TP3)-$2570 (TP4)

📌Key Considerations: 📝

•Monitor economic data releases closely as they will significantly impact market movements.

•Adjust stop-loss levels to manage risk effectively.

•Be prepared for potential market volatility around the release times of key economic indicators.

📊💹Fundamentals that might impact XAUUSD: Date: 4 Oct, 24 📌 (NFP DAY)

US LABOR MARKET DATA: WHAT’S NEXT FOR THE FED?

Markets are closely watching tomorrow’s US labor report, as it could heavily influence the US dollar, commodities, and stocks. The data will also guide the Federal Reserve on future interest rate decisions.

WHAT TO EXPECT:

PREVIOUS DATA:

In August, the US added 142,000 jobs, falling short of the expected 164,000. Unemployment held steady at 4.1%, while hourly wages grew by 0.4%, exceeding forecasts. This prompted the Fed to cut interest rates by 0.5% during its September meeting.

SCENARIOS AND MARKET IMPACT:

🟢 Positive:

Jobs >140K, unemployment <4.2% — Dollar index could rise above 103, delaying rate cuts. Negative for gold, stocks, and crypto.

🟥 Negative:

Jobs <140K, unemployment >4.2% — Dollar index may drop to 101, boosting rate cut expectations. Positive for gold, stocks, and crypto.

Conclusion: Stay alert and prepared to seize new trading opportunities based on how the forthcoming data impacts market sentiment. Our previous Buy and Sell zones have demonstrated their significance, achieving. We will continue to refine our strategy as new information emerges.