XAUUSD (Spot Gold) NFP DAY ANALYSIS -2nd August 2024

Gold Price Rebound Amid Market Dynamics

Gold (XAU/USD) reaching a high of $2,468 today, August 2, 2024, at 12:45 PM. Price rebound is influenced by Federal Reserve decisions, economic indicators, Asian market dynamics, and geopolitical factors. The interplay of these elements continues to shape the market outlook for the precious metal.

Federal Reserve and Economic Indicators

•Federal Reserve Decision: The Fed has announced that there will be no interest rate cuts for now, but there is a 100% chance of a rate cut in September.

•Economic Data: Upcoming high-tier data releases in the US could influence the next directional move in gold prices.

•Market Reactions: The risk flows are diminishing the appeal of the safe-haven US Dollar, and US Treasury bond yields are affected by expectations of a dovish Fed hold this week.

Market Trends

•US Treasury Yields: US 10-year yields are slightly above four-month highs, while the 2-year yield remains at its lowest levels since February, closely tied to interest rate expectations.

•Gold Price Movement: Gold crossed the $2,460 barrier before the NFP data release, covering a significant $100+ movement.

Geopolitical Factors

•Middle East Tensions: Eased concerns over a regional war in the Middle East have improved market mood, helping gold regain ground lost earlier in the week.

•Israeli Response: Israeli authorities have retaliated against Hamas and Houthi Hizbullah by killing their commander and Lebanon Outrage for Revenge but aim to avoid a regional conflict, calming market fears.

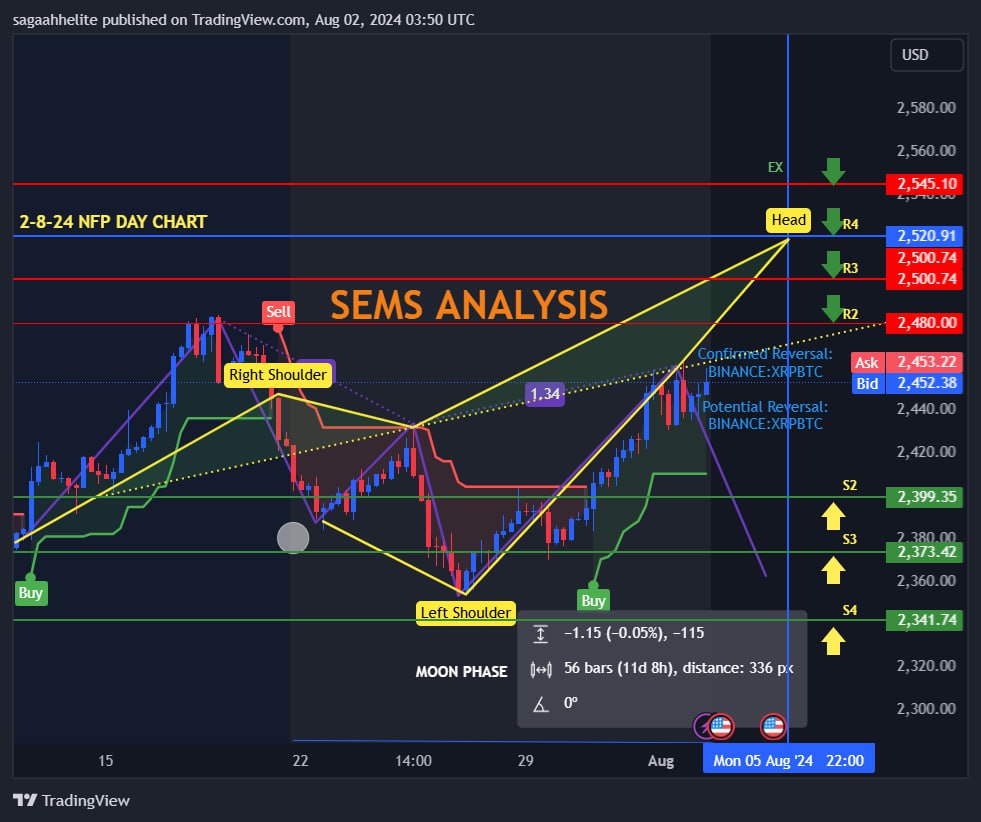

Sell at: $2472-$2492-$2520-$2545

Buy at :$2399-$2373-$2341-$2320

CMP -$2452.63 (as of writing)

Warning: Do not risk more than 5% of your capital. You might lose your money.

Warning: Do not risk more than 5% of your capital. You might lose your money.

Data Scheduled to be Published at 18:00 hrs

18:00-Average Hourly Earnings (YoY) (YoY) (Jul)

18:00- Average Hourly Earnings (MoM) (Jul)

18:00-Nonfarm Payrolls (Jul)

18:00-Participation Rate (Jul)

18:00-Private Nonfarm Payrolls (Jul)

18:00-U6 Unemployment Rate (Jul)

18:00-Unemployment Rate (Jul)

Trading Strategy: Given the current market dynamics, we suggest the following

For Potential Rebound:

- Buy Entry Target Range: $2475(TP1)- $2489(TP2)-$2505(TP3)

For Potential Downtrend:

- Sell Entry Target Range: $2410(TP1)- $2385(TP2)- $2366(TP3)

Technical Status: XAUUSD:

D1 SMA100-P (2336.95) Buy

H4 SMA100-P (2418.79) Buy

H1 SMA100-P (2410.40) Buy

H4 SMA200-P (2366.39) Buy

RSI(14): Status: Buy

STOCHRSI(14): Status: overbought

ROC: Status: Buy

William%R: Status: Overbought

ATR(14): Status: Overbought

SOC: Status: Sell

Ongoing Geo-political Tensions:

Israel – Hamas- Escalating

Russia – Ukraine

Middle East Instability – Escalating