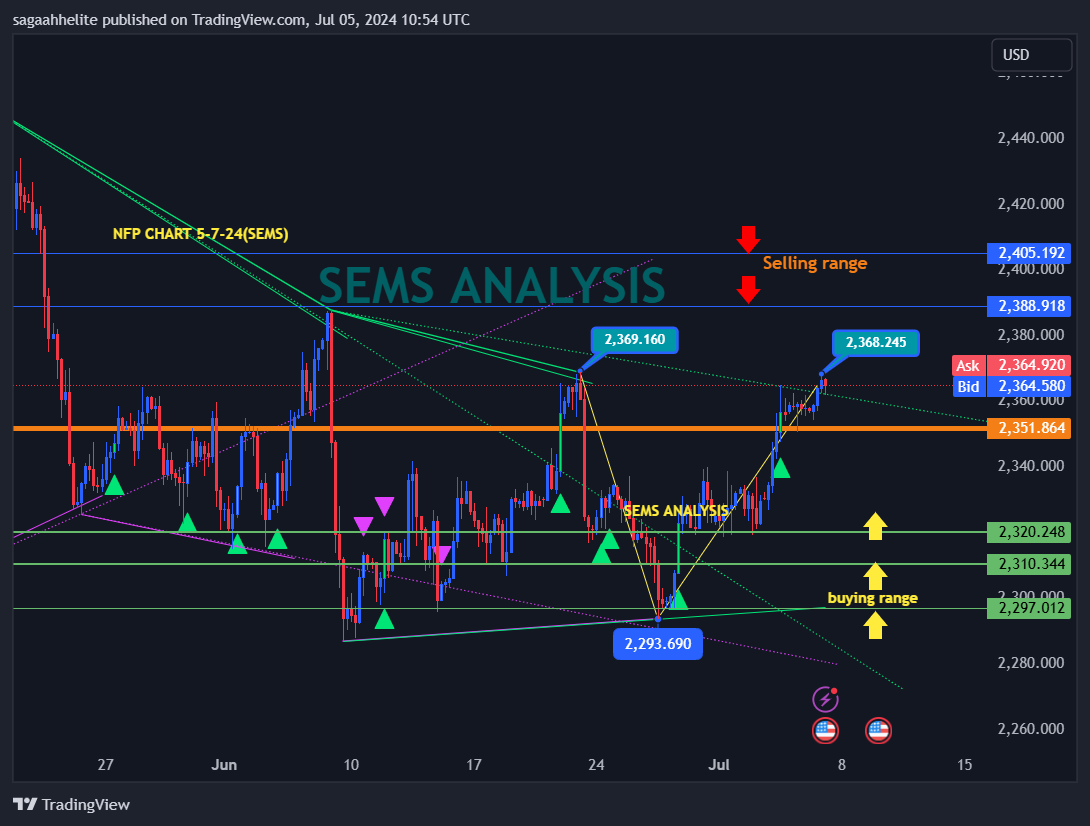

XAUUSD NFP DAY ANALYSIS 5 July 2024

Gold (XAU/USD) Update

Gold remains slightly Bullish from Wednesday in $2355-$2368( high on 5-7-24 at 13:47hrs, below this range is influenced by Futures traders covering short positions and long-term investors seeking bargains on $2380-$2420 levels.

Geopolitical Tensions:

Persistent geopolitical strife in the Middle East and Ukraine, a rightward political shift in Europe, Trump’s influence, and growing ideological, political, and economic divides between East and West – illustrated by the BRICS bloc’s expansion – pose significant threats to global trade stability.

Key Points Market Drivers:

- Futures traders: ’short-covering and long-term investors’ bargain hunting

- Geopolitical Issues: Middle East, Ukraine, Europe’s rightward shift, Trump’s influence, East-West divide, BRICS expansion

- Gold’s Role: Safe-haven asset, alternative to US Dollar( De-Dollarization Effect)

- Gold Price Range: Gold remains confined due to the US Federal Reserve’s (Fed) indecision on cutting interest rates.

- Opportunity Cost: High opportunity cost of holding non-interest-paying Gold persists as long as the Fed delays rate cuts.

- Fed’s Impact on Gold: Potential positive impact on Gold when the Fed begins reducing interest rates.

- Inflation Data: US Personal Consumption Expenditures (PCE) Price Index fell to 2.6% YoY in May, moving closer to the Fed’s 2.0% target.

- Fed Officials’ Stance: Richmond Fed President Thomas Barkin emphasized “lags” in monetary tightening and potential for higher service and shelter prices. San Francisco Fed President Mary Daly noted cooling inflation but cautioned it was premature to discuss rate cuts.

Key Considerations:

- Monitor economic data releases closely as they will significantly impact market movements.

- Adjust stop-loss levels to manage risk effectively.

- Be prepared for potential market volatility around the release times of key economic indicators.

Conclusion:

Stay alert and prepared to seize new trading opportunities based on how the forthcoming data impacts market sentiment. Our previous Buy and Sell zones have demonstrated their significance, achieving over 85% accuracy month after month. We will continue to refine our strategy as new information emerges.